“I met her in a club down in old Soho

Where you drink champagne and it tastes just like Coca-Cola

C-O-L-A, Cola”

- The Kinks, “Lola”

When Ray Davies fell for that dark brown voice he was ultimately in for a bit of a surprise. Less shocking and more welcome, this week social security beneficiaries just got upgraded to champagne with their COLA.

The 8.7% bump is the largest increase in the COLA (Cost of Living Adjustment) since 1981. It comes on the heels of rabid inflation. It’s also further to the 2021 increase of 5.7% - the previous four decade high. The price of everything from bubbly to broccoli to bus fare has increased, and it’s causing a lot of tension on both Main Street and Wall Street.

Beneficiaries will see this boost passed through starting with checks in January 2023. The average recipient gets about $20k a year, so this means $1740 additional dollars in their checking accounts. Effectively an extra month of last year’s payments.

As you likely already know or suspect, Social Security is both meaningful and complicated. Benefits are calculated with a Kafkaesque arithmetic that is dependent on things both within and outside your control. Broadly the more you make and the longer you wait, the more you’re going to collect each month. But it’s not quite that simple.

(Skip two paragraphs if you don’t care about the nitty gritty.)

While to some extent we have agency over our earnings, you don’t have much say over the year you were born or the average income of other wage earners at the time you were contributing. There is a standard of living adjustment that relativizes your earnings to your peers. The baseline calculation (Average Indexed Monthly Earnings - AIME) is a reflection of the general changes in wage levels throughout your employment history.

This figure is then run through another metric, called the “Primary Insurance Amount” (PIA), which layers on a progressive scaling factor to the benefits - lower earners get a higher benefit relative to their contributions. There are three tranches, where you get 90% of the value of your first ~$12k in earnings, 32% of the amount between $12k - $74k, and 15% of the remainder up to the cap of $142k.

Did I lose everyone yet?

One of the biggest impacts an individual can have on their monthly benefit (other than maxing out your cap) is delaying retirement. The final check amount is adjusted based on when someone chooses to begin receiving SSA benefits. The “normal retirement age” has been codified as 67 for anyone born after 1960. You have an eight year window between when you can start early at 62, or when you’re required to take delayed benefits at 70.

The difference here is significant. If you maximized your contributions, today you’d be due for $3420 a month at the ripe old age of 67. If you’re 62 and can't wait, the check drops by thirty percent to only $2400 a month. If you’re 70 today and have managed to hold out, the benefit is $4250.

On a monthly basis, those numbers sound strikingly different. But how impactful are they really?

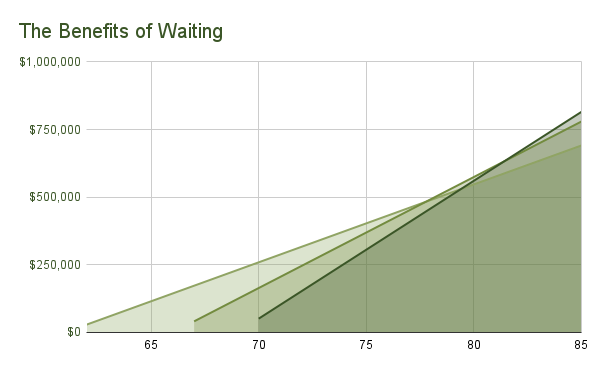

Average life expectancy has increased by almost 10 years since this theoretical retiree was born in 1960, but once they’ve made it to 67 years old, the average life expectancy is about 84 years old. Making it to 70 only increases this by a few months. Here are the cumulative benefits collected by three different retirees, all born in 1960 and hitting their window today.

The retiree who waits until 67 eclipses the 62 year old in total benefits received by about age 77 and a half. The patient 70 year old passes the 62 year old at 80, and the 67 year old just past 81. If they hit the average life expectancy of 85, the late taker will beat the standard withdrawal age by $35k and early withdrawals by $124k. This gap widens as you live longer - roughly doubling by age 90.

Those differences are significant, but optimizing for maximum gross cash flow may not exactly be the right track for everyone. Starting at 62 means you’ve received a head start on over $200k to enjoy your life during the healthiest stage of retirement while the hold out is still waiting. You only start to fall behind after 15 years of retirement.

Cash flow is what pays the bills for today’s experience, not an account’s high water mark. If it means you can do more of the things you want, when you’re able, just do it.

Social Security is also a meaningful part of most retiree’s plans. The average benefit is about half the current median wage, which can cover a lot of living expenses, especially in a period when most people are spending less money on discretionary items. At least one third of your income up to $142k is covered if you’ve contributed for long enough.

Jokes about the cost of millennial avocado toast aside, inflation does hit retirees differently than the average wage earner. Expenses like healthcare make up a larger portion of a retirees budget, while transportation and food costs less so.

Headline inflation numbers come from the Consumer Price Index (CPI) that is technically termed the CPI-U, and is a measure for the cost of living for “All Urban Consumers” representing 93% of the US population. The SSA uses the lesser known CPI-W to determine the COLA adjustments, even though this more narrow sampling only includes households who are employed wage earners- about 29% of the total population.

There have been some interesting proposals about how to best calculate the inflation rate for those depending on SSA benefits, and the administration has been tracking a CPI-E (elderly) figure since the early 1980s. Over the last 40 years, the average difference has been about .2% higher for CPI-E, but that has narrowed more recently.

Despite what it feels like when you go to the doctor, the inflation in medical care has actually continued to decline over the last 40 years. Inflation for that specific line item has come down- which has about double the weight in the CPI-E - while long term rising transportation costs have increased inflation for the broader CPI-W.

At the end of the day, none of this is an exact science. The fluctuations of the economy are multi-faceted and price increases are felt in unique ways across consumers.

The adjustments to the retirement benefits are an important part of having a system like social security. The Federal Reserve likes to roughly target inflation around the 2% level, though they don’t have an exact mandate. Compounded over a two decade retirement, this could wreak havoc on a retiree’s budget - especially when that target figure can range as high as the 7-9% readings we’re seeing this year.

So what’s the options angle?

Mainly, COLA covers your interest rate risk. When your wages aren’t getting corrected upwards by market forces, it’s a huge risk to be short rho. Inflation is a bear that eats directly into your day to day expenses. It’s not just a discount function on long term equity valuation, it’s an in your face reality.

The other benefit of social security is that it reduces your market delta when calculating your overall nest egg needs. Most retirement savings plans include a fair amount of equity risk. When you’re young and earning, this makes sense on long horizons. It sure has a lot of churn as everyone who’s brave enough to open their accounts is well aware these days.

The average saver who is hitting retirement today at age 67 has seen their stock balance go through major percentage point swings. Since they first got a job in 1977, they’ve seen the market drop by more than 15% ten different times, with 4 trips worse than 25% and two brushes with half off. Now raise your hand if you think things are likely to get less volatile.

While everyone’s retirement needs are different, at the maximum benefit level, only two thirds of your budget is subject to market variation. Even if you want to spend at the 1%er level, your SSA benefits still cut your delta by 10%. Every little bit of certainty helps.

It wouldn’t be an options conversation without bringing up tail risk. Like with any investment, credit worthiness matters. Those benefits are only as good as your faith in the US government’s funding of this program. The current 5 year CDS for the United States implies a 0.36% chance of default. Not quite as good as the Netherlands (0.21%), but fairly low risk. There’s a pretty good chance Washington is still writing checks for many years to come.

Social Security has some program specific risk too. CDS are protection on sovereign bonds, while it is up to a Congressional lawmaking how the benefits program is funded. Current estimates suggest that the reserve will deplete itself by about 2034, at which point unless there are changes to contribution taxes, future retirees should only count on about 80% of their benefits.

TDLR; Social Security neutralizes your rho risk and cuts your retirement plan’s delta, but there is some tail risk to the program.