No matter the position, you have exposure to something.

If you put your money in cash - you’re short inflation. If you put your money in Bitcoin, you’re short the US dollar and Gary Gensler. And if you put your money in the equity benchmarks, these days you’re long a lot of Big Tech.

A market maker doesn’t want to have any delta. That’s liquidity provider 101- hedge your stock. Unlike hedge funds that might not be buffered at all, the main secret to a dealer’s edge is neutralizing that call sale with a stock buy. (Contrary to popular belief it doesn’t come from manipulating the stock or front running your flow.)

Options are all about volatility - but to lock in a volatility level you need to trade stock against the position. Both at the time of trade and on a continuous basis. If you aren’t delta neutral, you’re taking a leg.

We get an appreciation for how tight markets are, when you see how quickly the bid-ask spread can shift. The one month ATM call in SPY right now is worth $11.02, with an implied vol of 14.43%. On a nickel wide market, selling this at $11.05 has $0.03 of edge with stock at $592.93. As you guessed, the call has a 50 delta or hedge ratio, so if stock goes up $0.06, the edge is gone. Alternatively you can pay up for stock and lock in an implied vol 4 basis points lower.

Herein lies the temptation to get cute. With a razor thin margin it only takes a little bit of a stock move to see any potential profits melt away. Whether everyone else beat you to the trade, or you got picked off on a slow stock feed, sometimes it pays to wait until stock drifts back down.

Of course it can go the other way, which is why the risk manager will sometimes even ask the most seasoned trader why they have 10k deltas in TGT.

One response to this would be - “but I have offsetting vol dollar deltas in WMT!” Leaning two big box retailers against each other should be reasonable, but there are a lot of times it isn’t, and it’s easy to get wrong. Not only would the options positions evolve independently, but their price correlation is only about 40%. Nice try.

There are smarter ways to do this than run a quick Excel function, and executing well here with baskets and rebalances can be an edge. With the appropriate weightings, you reduce transaction costs and create a cheaper hedge. Not for anyone managing less than 8 figures with complex positions.

A global hedge with an S&P product is also a reasonable delta adjustment. In a diversified book you mitigate the market beta with a single offsetting trade. Your total SPX delta is beta weighted by price, and sums across assets to show how much your position is going to move relative to the S&P500. A delta of 55 means for every point the S&P moves up you expect to make $55.

Individual investors want a delta. They need delta exposure to fund that future lifestyle. The whole goal of buying anything from low fee diversified index funds to 2X MSTR is to have a positive delta. (In things that go up.)

If you have more holdings than a few ETFs, it’s an interesting check to see what your SPX delta is. The delta from an equivalent amount of capital in AAPL stock would be 107. Even if the Mag7 is driving the market, Bitcoin would give you 126 SPX deltas. Berkshire only gives you 61. These are going to change over time as assets move more and less independently from the market.

Options market makers trade stocks to neutralize their options deltas, while individual investors look to options to ring fence their stock deltas. If you want a perfect options hedge, you put on a collar and neutralize the deltas 1:1. Everything else is going to bend and wiggle in price and time space before expiration.

An interesting component of the hedged equity trade is that the delta of this exposure changes over time - quite a bit. A put spread collar will hedge your position quite differently as expiration approaches and spot moves. Some days you want the market to go up, other days it makes very little difference.

I highly discourage investors from tracking their portfolio this closely. If you spend your days rooting for the S&P tick by tick, I’ll lend you my book on sous vide - you’d be better off watching that cook. But if you’re just “long the market,” technically every swing matters just a little bit - no matter when it happens.

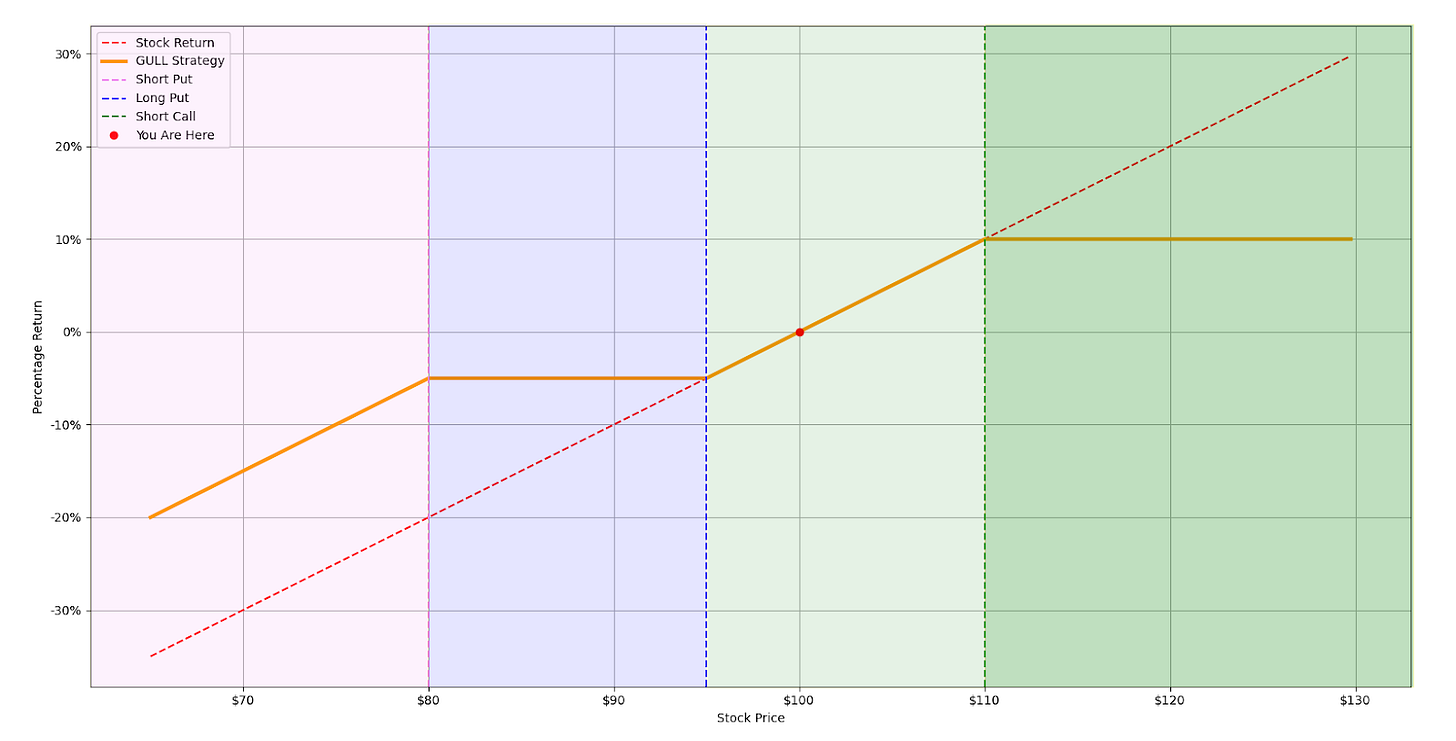

When the underlying is between the long put and short call (light green zone) or below the short put (light pink zone), you’re along dollar for dollar on the ride. This is where you’re either beyond the range of buffer protection, or you’re in the wiggle room between the start of the buffer and the top of your upside. The purple and dark green zones have a “flat” yellow line because in these ranges options directly offset the movement of the stock.

The chart above is the expiration PnL, any time before that the curve won’t be so severe. If there’s time on the clock you can still rally out of the hole, or drop back below your short call strike. If we think of this in SPX delta terms, our offsets are changing as the structure decays and stock moves.

Another way to visualize this is to imagine the delta of the position at expiration. The below yellow line is a live example with SPY, where in the buffer ranges we have absolute offset (-100), but below and in between we have 0 offset.

How much offset you are getting at any given point also depends on how far away expiration is. The green line in the above chart is your delta today at different spot prices. Eventually it will collapse into the yellow expiration line, but for now it isn’t so binary. A 1% move up or down will be roughly offset by a 44 delta overlay. If we get as high as the sold call strike, you’re now going to be offset at a 60 delta.

Fast forward to a month remaining, and deltas start falling towards their expiration levels. The steepening of that curve is the increasing gamma. Now relative movements around the money are only hedged by half as much delta. And if we are in the middle of the buffer zone, we’re getting as much as 85% offset on each SPX tick.

Other than the gut check when you open your March 2020 brokerage statement, long only doesn’t care what happens between point A and point B. Adding an options element necessarily introduces some timing considerations. Those goalposts to care about, move around every time you reset the trade.

The move from SPX 5000 to 5500 will always be a 10% increase in pure equity value, no matter what the path was. But if you’re hedged and that happens in your put spread zone, you’re already covered and there’s not much to see. Or, it happens right through your short call strike and you only capture the first part of it. Maybe it’s in the sweet spot that came just at the right time.

What sounds like a bug is actually a feature. The fact that your options decay and expire means that put spread will collapse to its settlement price and offset more of your losses than it seems like on day 2. And the fact that the upside has a delta is the only reason you can trade it for protection.

Knowing what your delta, or broad market exposure is can be tremendously helpful. Just remember that as soon as you layer in options, that daily exposure can vary fairly dramatically. And until expiration, it doesn’t really matter.