The more you want it, the more you’ll pay.

When the seller looks into a buyer’s eyes and sees desire, he knows there is a premium to extract. Good bartering and good poker is the art of hiding that desire.

In a negotiation, they say one of the best tactics is being able to walk away. An even better tactic is to convince the other side that they are actually the one getting what they want.

Anyone who has bought or sold real estate knows the emotional element can be even more significant than the financial. You're not just buying a share of stock that you can flip the next day if your mood swings - you’re investing in a home where you’ll make *memories*.

The city of Chicago has over 8,000 listings for houses that are under $1M. If you want to be picky and narrow that down to the popular “yuppie” north side neighborhoods between $500k-$1M, there are still 800 different offerings to choose from. When you finally go to contract, the seller knows you’ve selected something special. Once you’ve exposed that desire with an offer, you have little leverage to extract concessions.

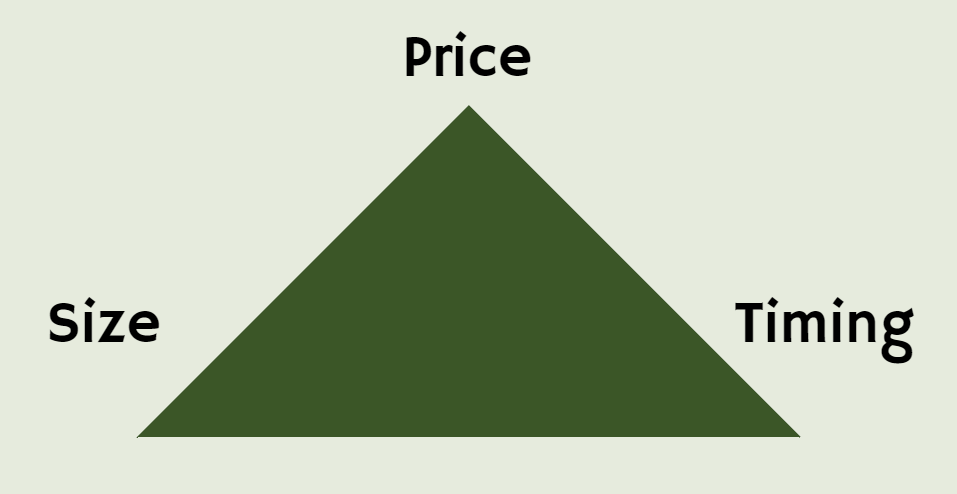

Real estate deals are big and chunky - often the largest investments individuals make. But every transaction in any market is rooted by the seeds of desire. How much do you want, how quickly do you want it, and how much are you willing to pay.

This transaction trilemma shows up everywhere. Whether you’re buying stock or ordering late night pizza, you have to sacrifice on size (quality), timing, or price.

Over the last 5 years Domino’s Pizza (DPZ) has returned 224% versus the 108% of the S&P 500 - all on the backs of marginally adjusting the quality factor. They kept prices low and speedy delivery windows, but simply upgrading the cardboard crust was rocket fuel for their revenue and profits. There was edge in the sauce.

On a transactional basis in financial markets, these same factors hold true. Generally they fall under the umbrella of liquidity management. It’s impossible to get a big size done at a great price, immediately.

These are relative metrics of course, and fast in one market might be slow in another. Crypto trades 24/7 while emerging markets bonds might be by appointment only. A million dollar trade doesn't wake up an SPX local, but a $10,000 sell order will spook the alt-coin of your favorite crumbling DAO.

Balancing these factors is critical to achieving great execution. Patience is a must, and you can never let the other side know how badly you want the trade. Showing big size on the screens at an aggressive price is a recipe for spooking other participants. Putting out cheeky one lots and “ice-berging” your true size lets you pick away.

The only two elements that determine your total return are the price you paid, and the proceeds you received upon sale. Contextualizing these against the holding period is very important however. If your investment horizon is 20 years, scrapping for an extra dime on the transaction matters far less than your ability to keep that investment for the duration. As that holding period shortens, the basis points become increasingly significant.

For frequent transactors, algorithms become a must. The cold logic of code can help mask your desire, and impose a systematic process to execution. Common forms of this are the “Volume Weighted Average Price” (VWAP) format, which simply seeks to execute your order alongside the average prices in the marketplace.

Liquidity providers are often on the other side of these orders - so how do they make money if they’re always on the receiving end of someone’s impulses and trigger finger?

The most insightful comment I ever heard from a liquidity pool salesman was that “we arbitrage time.” What that Goldman Sachs-speak means, was that he’ll give you what you want now, because his balance sheet has the capacity to survive the duration of trading out of that risk. All for a modest fee.

When you are looking to make a trade, or investment, there must be a self reflection of how badly you want it. When I’m dollar cost averaging my long term portfolio, I’m happy to let an automated program pay the offer and be relatively price insensitive. The rigor of that process will be its own reward.

As trading becomes more active, it must also become more nuanced. Trading at off hours will raise your costs. Putting out big orders will cause the other side to fade. Non-standard packages of disparate trade legs causes the spidey sense of liquidity providers to pique - which pads the premium you’ll pay.

Great execution demands that we must be aggressive about our convicted and “thick” desires. It also means that we must overcome impatience, fear, and pride to be delicate and tactical when executing with nuance.