“I want Paw Patrol!”

US Open fever had caught everyone except my daughter. I thought that watching the women’s final on TV while she had an early dinner would be a treat, but instead it was a tease.

The on and off the court drama had us (me) hooked. We rarely watch sports at home, but here Daddy was, insisting we tune in. Even Mom agreed! Sinner and Alcaraz are playing incredible tennis. Did Bonzi deserve another first serve for match point? Is not apologizing for a net cord that breaks your way rude or worse “uneducated”?

The women’s final was brief, with Sabalenka quickly defeating Anisimova in straight sets. The tease was over for one of us, but the energy just made me want to go out and hit some balls.

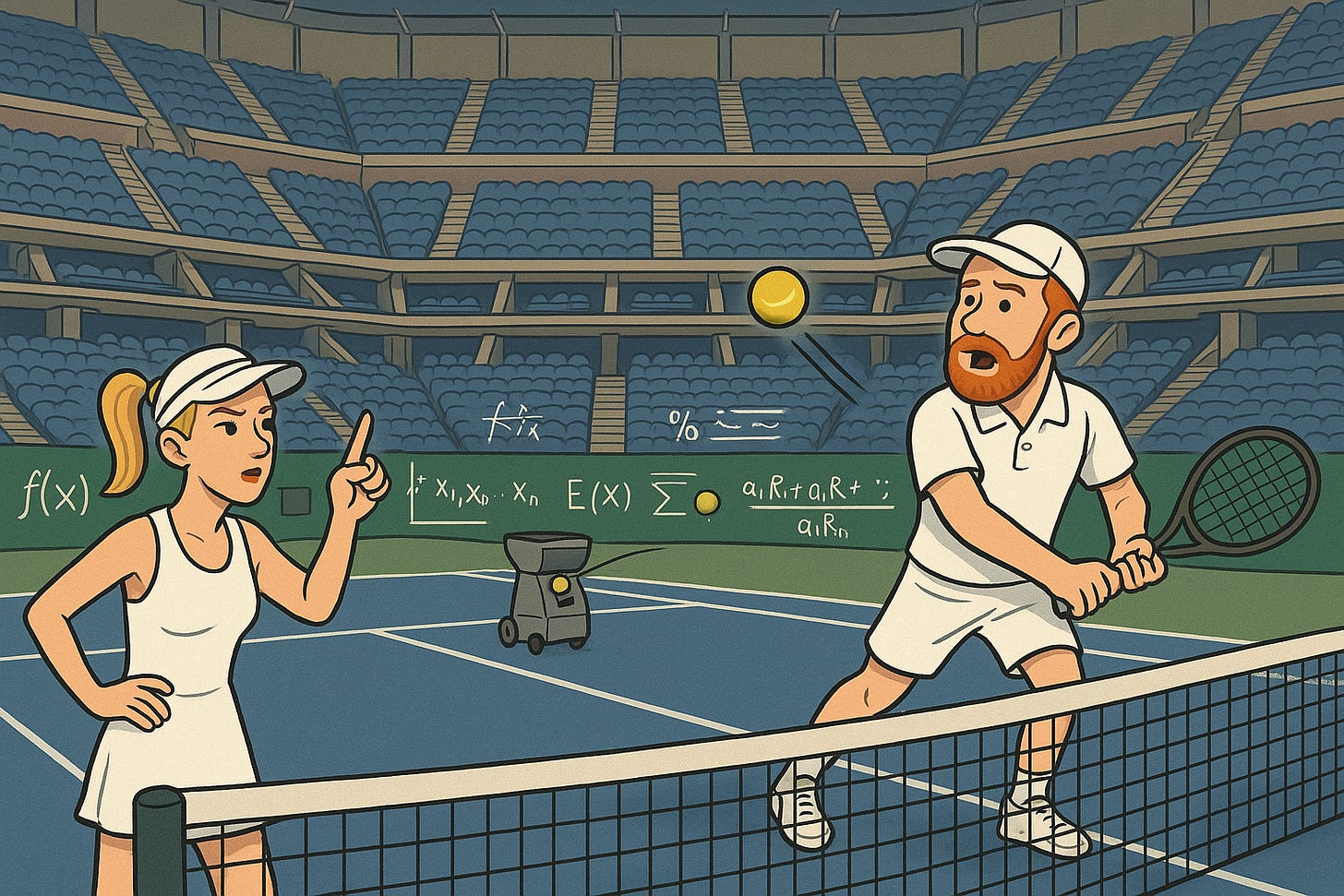

When you can’t find a partner, the next best thing is the ball machine. Not only does it return every single shot, you can zero in on practicing your volleys or baselines.

Pumped up from watching the big guys and gals hit, I wanted to play with my back against the wall. Several feet behind the baseline, I was ripping shots cross court. Some hit the net, but when the winners landed it felt great.

Until, for the second time in 24 hours, someone told me I was doing tennis wrong.

“I don’t like that. Seriously, even {club champion} isn’t going to play you that deep. You shouldn’t be training for those shots.”

Our pro doesn’t mess around. The no nonsense advice was as unvarnished as it was true. Most of the men I play with are focused on getting a clean shot over and within the lines, and secondly not setting up the net player for an easy volley. Cheap little dinks are more often winners than 100 MPH serves.

I was trying to be a player that I wasn’t. Maybe some day with enough reps I’ll get there, but I need to improve the consistency on the type of shots I could expect in matches. So I dialed back the settings and started focusing on cleaning up my backhand.

Just as important as learning from the experts, is learning who you are.

An important part of the trader training program at Group One was the mentor/mentee relationships. There’s a lot of hard facts to be learned, and you can’t get very far if you don’t know the synthetics. But once you can have a conversation with these building blocks of trading, the nuance of each individual’s game starts to become clear. There’s a lot more than meets the eye.

With a basic understanding of edge, one of the worst traps a young trader can fall into is trying to mimic the trades of someone else without context. There was a lot of debate internally about whether traders should be able to see each other’s activity, because of all the different externalities of mimicry. (Novice or expert.)

Everyone with a data feed can see exactly what’s happening in real time, but knowing that another trader in your firm was nibbling at an order provided positive confirmation that it was good. Which is precisely why they didn’t want you to see it.

In the pits they’re called hand raisers. Market makers who aren’t necessarily the first to make a two sided market, but are quick to raise their hand and pile on. This does add liquidity. It means the customer gets a better price, and the risk is spread around.

On the really juicy orders a market maker might want to take down the whole piece themselves, but more often than not you’d rather have a lot of dispersed bets than a single face-off with a customer.

The flip side is that hand raisers are free loaders that lean on your effort and pricing. Fortunately doing exclusively that rarely leads to big success. Copy when necessary or helpful, but the real bucks come from tending your own garden.

Reading the electronic orderflow has its own subtleties. There’s generally less information about who’s going which way, but as a data feed it has the benefits of being immediately digestible by algorithms and pattern matchers.

There’s a lot that an active trader can pick up. Seeing activity transpire and fitting it into your mental model of what's driving pricing will quickly alert you of risks and help jump on opportunities.

But just because someone else made a trade doesn’t mean it's the right trade for you. Even if you’re both market makers, they likely have a different overall book. An offsetting risk might cause them to lean more aggressively into something that for you is undercompensated and imbalanced.

The other problem with reading too much into the tape is that we don’t know what else is happening that motivated the trade. Similarly, the main problem with reading into dealer gamma positioning; you just don’t know what hedge, dispersion, or other trade they might have on.

High turnover, active traders are always chasing the activity and trying to divine something from the next print. But the same impulse to copycat hits the slow and steady investors too.

You don’t know what your neighbor's financial picture is, so if he’s preaching the virtues of his new stock pick or AirBnB cash machine, it’s best to take that with a grain of salt. Not just because he’s wrong, but even if he’s right, who says you can walk a day in those shoes?

Envy is an incredibly difficult emotion. The signals of success nag on the woulda-coulda-shouldas of memory. But you can’t copy the outcome without understanding the sacrifices and path it took to get there. What you learned/endured along the way.

If you start trading the same way as someone else, you’re going to get yourself in a bad position. Two traders can walk in with a completely blank slate and take different sized positions. Some of it is because they’re going to have different opinions about the quality of edge.

But another important part is that the guy at the next desk over sells a 1000 lot straddle because he’s got nerves of steel hedging his short gamma. If you don’t, all that extra edge is going to be lost to your mismanagement. Time spent hitting balls from the baseline just to lose to a guy with a clinker of a forehand.

A book can teach you the Black Scholes model. A mentor will explain to you why they passed on this order and doubled down over here. Perhaps even a technique to quickly update settings during a flurry of activity. Imitation is central to how we learn as humans, from infancy to modeling in-group behavior. Soak up as much as you possibly can.

But in every game you need to learn to hit it your way. You’re the one in charge of both finding and implementing that picture of success. Make sure it works for you, where you’re at.