If you play with fire, you’re going to get burned.

That’s why I love cooking; inevitably something browns too fast or a sauce doesn’t quite set. But the egg timer is ticking, and there are hungry people at the table. Throw in some flour; figure it out.

Everything starts with good ingredients. Locally sourced, seasonal produce. Heritage breeds of pork and wild caught seafood. It’s how they’re raised, but it’s also important how they are prepared for cooking.

When you walk into a French butcher shop - la boucherie - it’s time for a serious discussion. The environment isn’t exactly macho, but it has the same no nonsense intensity as a New York deli. Real talk about food, I’m not scooping your bagel bro.

<< Monsieur Bonjour>>

<<Bonjour Monsieur>>

<<What would please you today?>>

<<A half kilo of the filet please.>>

<<How will you be preparing it?>>

(Confused)

<<Uhh, with a jus and gratin?>>

(Annoyed)

<<That’s fine. But regular or reverse sear?>>

(Forgetting the difference, and unclear why this matters)

<<Yes, in the oven.>>

(Bemoaning the ignorance of foreigners and cursing inaudibly)

<<Bon, alors, a thumb or a pinky?>>

(Confident I already have my appetizers planned)

<<Just the filet is fine, s’il vous plait>>

(Life pouring out of him as he demonstrates different thicknesses on the loin)

<<Monsieur, how should I tranche your filet de boeuf?>>

The butcher knows that once you leave the store, whatever disaster unfolds is your problem. But he can do his best to provide you with the right type and cut of meat from what he deciphers of your projects.

Next to the boucherie there is a patisserie, where rows of confections sit below freshly baked baguette. The baker may have to rise at 2am to start his bread, but once it goes in the oven, there’s nothing to do but hope it rises and let it bake.

Options investors want it to be like baking - find the perfect recipe and eat your distributions. Three sharpe backtest, ready to deploy. It’s almost that easy with a passive equity strategy. But slinging vega is open flame cooking. There are constant adjustments to be made.

Despite this impending kitchen disaster, the butcher is asking an important question. Variance in outcome is guaranteed, but it's still extremely valuable to get the right setup in place. Proper planning prevents…

Typically allocation theory asks food pyramid type questions. How many units of fruit and vegetables do we need compared to proteins and grains. Burgers with the boys for lunch? I’ve got a great farro and carrot recipe for dinner.

We rebalance to avoid risk - cardiac or financial. With no idea what the future brings, it’s prudent to regularly set your financial ballasts according to some guiding principles and expectations.

A fixed portfolio will see its weightings change according to the performance differences of each asset. If stocks rally 10% in the first quarter and bonds drop 6% (roughly Q1 2024), a simple 60/40 is now closer to 64/36. You’re up $37k on a $1M portfolio.

Because it’s unlikely that in the last 90 days you decided your exposure to equities should increase by 4 points, it's time to sell stock and buy bonds. The specific reason you do it on that day is Gregorian. Waiting until right now would have saved you $164.

That might not be material in this 10 day period, but a feature and bug of interest rates and returns is that they compound. Across lots of rebalances, your investments are realizing one specific path. If you had chosen to start a month or week later, it could be quite a bit different. And options can have a lot of rebalances.

Rebalance timing risk has been written about eloquently and extensively by Corey Hoffstein and the Newfound research team, also collaborating with NDVR on its effects in options strategies. For the popular hedged equity trade (a seagull spread, or GULL at Harvested), they found variations of up to four hundred basis points just from timing.

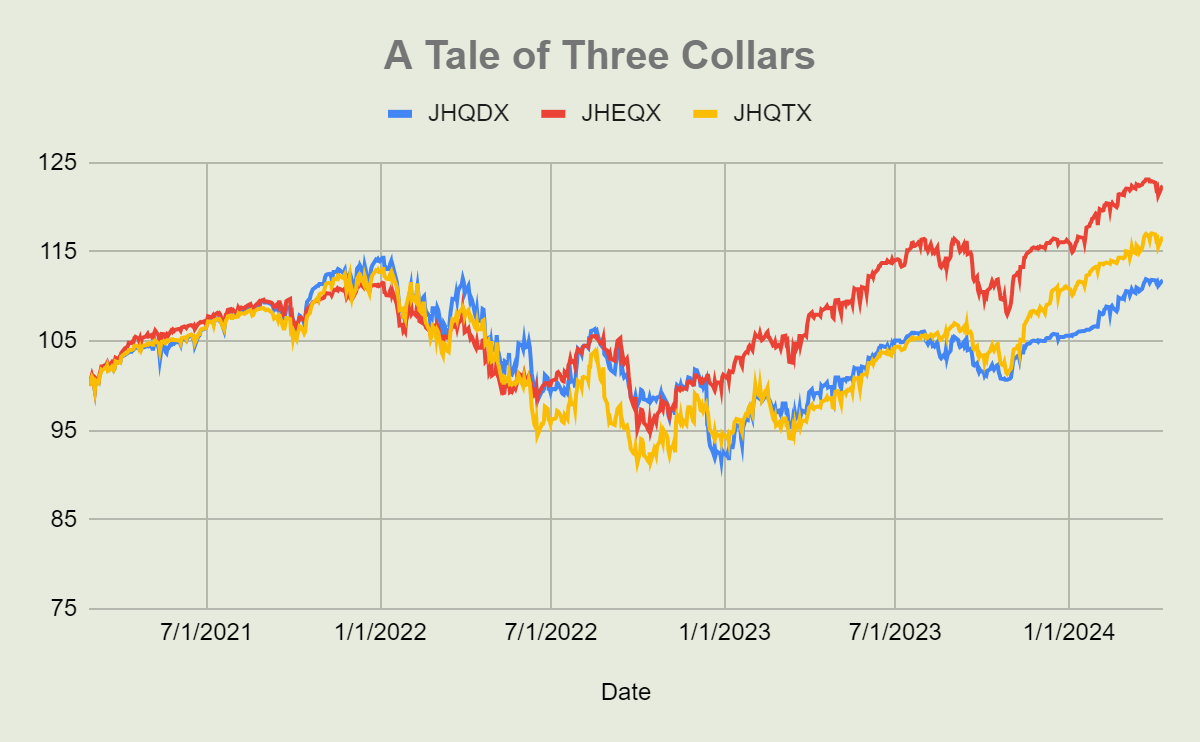

JP Morgan’s funds do this trade in the biggest size, adjusting their put spread collar every ninety days. As the assets ballooned, they split into three iterations in mid 2021, each trading a different month of the quarter. Performance tracks early on, but it only takes one or two lucky rebalances to create material return differences.

We all want to own the red line. But in February 2021, these three strategies were all targeting the exact same objective with the exact same implementation in the exact same market - the only difference was essentially random.

Market timing is impossible to avoid with an options overlay strategy. The calls and puts you align with your equities will decay and expire, settling to a value on a particular date, which means to keep that exposure you are forced to trade and rebalance.

Strategy rules are good in that they enforce rigor and are easy to test, but they can also force you into sub-optimal positions. A simple buy and hold can ride out the dips scratch free, but a zero cost collar that’s expiring has to reset if the calendar says so.

The call level is a major driver of outcomes for hedged equity. Depending on the cost of the fixed percentage put spread (5/20% here), the cash neutralizing call sale will be a different percentage out of the money. More is better, and hope the market goes up.

Even with a 10 day smoothing here, we see this value fluctuates by up to a full percent of return potential over 90 days. A March rebalancing looks a lot better than January.

Getting an average of all three monthly rebalances would be the most desirable. Owning the bucket that resets low only to watch the market rally would be painful, but roughly 66% less painful than if you were all in.

If you decompose what’s going on with that strategy, you have three hundred shares of an underlying stock (SPY in this case) and are short three calls and long three put spreads against it. But one of those structures expires in one month, one in two months, and one in three months. As the near month rolls off, you reset back out ninety days again.

Owning a basket of equities helps diversify your idiosyncratic risk, and tranching your options exposure provides diversification across time.

As options liquidity grows, so does the potential for finer slices. There are daily intervals two weeks out, weekly intervals six weeks out, and past that twice monthly. With enough capital to split across the various different tenors, the position can become fairly nuanced.

On trade date, the execution can be split up. Layering into a spread means you don’t buy the top of the day or sell the low. It helps if you have a VWAP algorithm, but you can also trade at 10am/12pm/2pm and achieve a similar result.

For options strategies that are independent of equities, there are significant benefits to balancing your exposure across terms. Vol strategies are hoping that realized variance is either less or more than expected, with the price constantly shifting. Deciding to sell condors once a month means you’re making a bet on a stochastic variable, by snapshotting its value across one of hundreds of possible windows.

Dollar cost averaging into equities with a bi-weekly paycheck works because over time they just keep going up. Even God Couldn’t Beat Dollar Cost Averaging. But with variance risk premium, the ebbs and flow of prices in between the fortnights are all part of that. There’s solid historical precedence for the existence of VRP, but it has to be actively captured.

I look at an S&P 500 chart going up and to the right and I want to just keep buying when I can. But I look at the 30 Day VRP charted behind that, and I want to always be collecting a little bit, because on any given path it could have an out of bounds outcome.

I want to get to the law of large numbers quickly, always having a little bit of exposure to a basket of positive expected value coin flips.

If you’re forced to pick spots in time against a mostly random variable, you’re going to deviate from the mean you were expecting, and that noise is a drag. PnL volatility kills compounding and rightfully punishes your Sharpe ratio.

No matter how you cook your meat or allocate your portfolio, slicing it up properly puts one less uncertainty under control.

Interested in learning more about rebalancing with options strategies? Check out last week’s edition of Portfolio Design to see how options overlay, leverage, and VRP strategies all benefit from splitting up exposure across tenors.

Looking for help executing tranched strategies? Whether it’s a basket of covered calls, hedged equity, or volatility premium capture Harvested Financial has developed proprietary tools to keep your strategy rolling along smoothly.