No synthetic for a commute

Vol #239: August 21, 2025

Nothing says summer in Brooklyn like an open hydrant.

While the fire department showed up two hours late with their big special wrench, once the water hit the 95* pavement all concerns washed away.

Dads marvel at new-fangled reusable water balloons as they unsuccessfully dodge water gun streams. Moms wall up against the ice cream shop, defending their strollers. All to watch the kids tentatively dip their toes in the water, and quickly make fast friends. Bodegas happily brown bag IPAs for thirsty yuppies.

When they close the streets for a summer block party, it’s worth a few cramped nights of one bedroom apartment living.

The sprinkler party was the main event (well actually, the arancini at Fausto was), but there’s plenty of other things to do on the water in New York these days. Despite the best efforts of Robert Moses, the city has slowly pushed past the highways encircling the isles, and found ways to enjoy an incredible maritime space.

From Astoria to the center of Rockaway, a ferry system connects all of the interesting waterfront points along the East River. Dumbo, South Street Seaport, and Governors Island are but a pleasant boat ride away. NYU has their own private barge to shuttle between hospitals.

The ferries add to an already significant public transportation network in the city. In a very cool way. While the MTA has plenty of problems, one thing you can’t deny it is volume. Ridership is 5x any other domestic city. We’re still rebounding from pandemic figures, but July 2025 saw three consecutive days of over 4 million riders, putting the whole system’s daily ridership larger than the population of half the states in America.

Fortunately I never lived in Hoboken (sorry Chuck) but it did mean missing out on using a ferry as part of my commute. From Brooklyn if you took the N/Q/B/D train over the Manhattan Bridge you got a great view of Dumbo, but it was the R train for me. From the Fourth Avenue entrance to the Rector Street exit, there wasn’t much pretty about this journey.

I’ve never been one to complain about the commute. Living and working in New York or Chicago, the office was always less than thirty minutes away. 13.5 if you took a fixie. Having some distance between the professional and personal space is needed. With my desk just across the yard now, sometimes I have to take a long detour past the wine barn to let the day’s events settle.

Before I was using the commute to ruminate about coding frictions with Claude, I was an aspiring young trader trying to keep my head above water. Everything was brand new, and how quickly you got up to speed was going to make or break your career. No trading team wanted the trainee that sucked at mock.

There was vocabulary to learn and floor pranks to dodge. There was no handbook, no substitute for experience here. Reading Taleb or Natenberg would tell you about distributions and how greeks change over time, but as for how to trade that, you need to see live fire orderflow.

The best thing you could do for homework was synthetics. Print a few sheets for the commute home. How quickly can you complete it? Use that space between the office and the flop house to sharpen your toolkit.

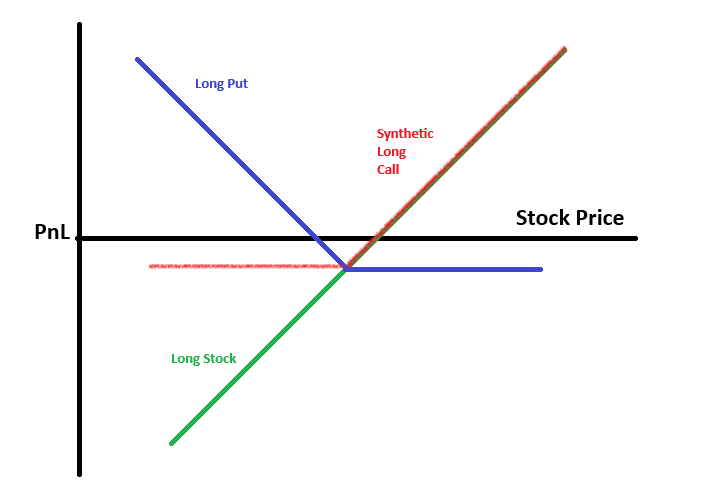

A synthetic relationship in options refers to the valuation link between calls and puts with the same strike. A call is a put and a put is a call, because when hedged with stock they’re both just bets on volatility at that strike. If you are long a put option, and long stock you’re synthetically long a call option.

The long put neutralizes your long stock on the downside - providing that flat PnL red line. To the upside you participate as stock goes up, but only net of the premium you paid for that put - the distance between the PnL breakeven line and the intersection of all three lines.

It’s a useful intuition. Sell an ATM covered call, and you have an identical exposure as selling an ATM put. All the downside, none of the upside, but for the little premium you get in both cases. Same as hedging your long stock with an ATM put. It’s just as if you paid the put price for upside exposure - i.e. a call.

The extrinsic value of a call and put on the same strike will always be the same - simply net out the moneyness of an option and adjust for interest and dividends (cost of carry). Now do that 50 times. How many sheets can you do on the ride home?

Call minus put. Stock minus strike. Add interest, subtract dividends. Nickel, dime, how much over?

We had all taken calculus and statistics. Some even linear algebra. Why were we doing simple arithmetic?

The basic explanation was that there was plenty of free money out there if you could buy calls for cheaper than the puts were bid. Intro to mock trading had a lot of layups where the calls could be bought for $1.50 and puts sold synthetically (after accounting for forward value and stock loan) at $1.60.

That wasn’t quite true, because if you see a put-call parity out of whack in the real world, it probably means the borrow rate on stock is about to change, or you’ve miscounted a dividend.

Besides, everyone is sitting behind a massive calculator that’s finding these opportunities multiples faster than any human could. Getting your mental engines running at competition speed was not about calculating the Black Scholes model in your head, it was about having the capacity to scan all the other fuzzy relationships and opportunities in the market.

Before asking if the straddle is cheap or expensive, you have to do a quick sum. It’s also interesting to know what an ATM butterfly is worth. Time spreads have you flipping tabs to get inputs, but are another spread relationship whose ebb and flow is information.

For model driven pricing, two months will have their own SABR curves. How does the pump in the front month compare to the back month? We naturally expect those wings to inflate in volatility terms as expiration approaches, is orderflow nudging that sooner than usual?

The quick mental math also hones your ability to estimate proportionality. Mock had us guessing deltas and racing to sell shares before the guy next to you. Of course that’s all done by an auto hedger these days, with a precise delta and algorithm to determine order prices. But knowing the relative size of this new stock position coming from this order was a nugget to store away.

With your brain constantly in mental arithmetic mode, everything gets sized up. Without even thinking about it, the subconscious is weighing your bid versus what the rest of the crowd or IM channel is showing. The only way to develop a spidey sense about something moving too much or too little is a well conditioned proportionality reflex.

If you don’t have synthetic sheets for the subway ride, try counting up your grocery bill as the items sit on the conveyor belt. Can you keep up? How close did you get to the total?

The benefits of mental math will help you add up or split the check quicker, and better calculate the real value of a discount. And all that can be flexed in the space of a brief but dedicated regular moment. There’s no synthetic for a productive commute.

Love this...I remember practicing synthetics on the subway!