It’s a beautiful time of year to go out for a walk in the woods.

The value of time spent in nature, catching the whiff of pine trees on a warm morning, or spotting the first leaves of mountain laurel is highly restorative. A good long delta walk.

Many of the trails I’ve been exploring recently surround a reservoir that was built in the late 1930s to provide fresh water to the burgeoning coastal cities. While the views today are spectacular, 12 billion gallons of water cover a once prosperous town.

The details will be familiar to many in the area. The largest lake in the state is about 15 miles north and exists for the exact same reason. The rapid growth of cities further south increased the demand for fresh water, and privately run utility companies were in need of capacity.

As early as 1920, the Bridgeport Hydraulic Company began buying land around the Saugatuck River, and was granted the privilege of eminent domain by the state’s General Assembly later that decade. The increasingly dominant iron mills of the Midwest, followed by the depression, left sellers in Valley Forge desperate. The utility quickly acquired the remainder of the land and began construction of their dam.

Some of the houses were moved to other locations in surrounding towns, and what remained was burned to the foundation. Can’t have floaters in the drinking water.

Fast forward a couple decades, and the public was able to reclaim significant portions of the previously seized lands and preserve them as open space. We now have a much richer landscape, to mollify the historical toll. It’s been a topsy turvy century for the valley.

On the trails, the path you take matters too. Thanks to all the tracking apps, I have a statistically significant sample size, and can tell you that difficulty is non linear. Hours in the woods have led me to believe that it looks closer to a theta decay curve.

At the outset, very little changes. A few days pass, you feel like the market has moved but any spread over 30 days has barely budged. Throw a couple light grades in there - the stride is practically identical.

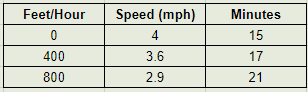

With a flat stretch, an intentional pace is about 4 mph. A few decent hills would be 400 vertical feet in an hour, and here is the noticeable inflection point where the speed starts to drop off. A mile with that vert takes me about 17 minutes, compared to 15 minutes on a level field. Add in another 400 feet and you drop even further. I can extrapolate this function with confidence, because if you put me in front of El Capitan, I’d make exactly 0 feet of vertical or horizontal progress.

If we slice a trek even finer, the same descriptive statistics might produce different final times. 400 feet of vertical over a mile is a good amount of elevation change, but rolling hills will allow for a speedier loop than a steep switchback up to a plateau and then back down.

The vertical feet change is telling us something here, but it’s not the whole story. Trading options is about trading volatility, but when push comes to PnL, it’s about the path that underlying takes in a certain time frame. How you get there really matters.

A topographic map gives a pretty good idea of what the route is going to be. Mesas or sine waves. We talk so much about historical or implied volatilities, but they are rough predictors at best. And those are only descriptions of vertical foot changes; the path can take many forms.

Large volumes create tight spreads, and we see those spreads converge on a fairly accurate pricing of volatility over longer time frames in the most liquid names. For 30 day volatility risk premium (VRP), SPY has both a mean and standard deviation of a little over 2%, on a roughly 15% IV figure. You could say that 2/3 of the time it’s over 86% accurate.

That’s pretty good - far from perfect and leaves plenty of opportunity - but the accurate measurement of volatility only tells part of the story. Whether or not there's a positive or negative VRP only really matters if you’re trading a variance swap product. Most of us are contented with listed strikes.

That’s important because 15% vol can realize in a lot of different ways. Over the course of 90 days and 15% annualized volatility, we see the same random process create a rise to over $125 and also a fall to $81.

Even better for the Good Vol, it’s relatively flat before a surge in the second half. Bet that was a good month to keep checking your brokerage statement!

These examples are far from the extremes. It only took four presses of F9 to produce two quite different results. Bad Vol might not even be the worst case, volatility isn’t constant and tends to pick up on the downside. And once it gets going, watch out for that conditional heteroskedasticity.

Volatility seems like it’s the most important figure. Options mean the VIX and VIX measures vol. It is significant - the level of volatility will have an impact on even fairly vega neutral strategies like a put spread collar. Secord order pricing of skew and term structure will change the amount of hedged equity upside by 1-2% in SPY.

But because the path matters so much, so does delta, and vice versa. We can look at all the indicators under the sun, but once your FIX message crosses the Rubicon into the exchange matching engine, you’ll get filled with more greeks than vega.

These exposures change as time passes and stock moves. The delta of a covered call gets lower and lower if nothing happens or stock goes down. 30 delta is the level of that call today. If stock drops you’re holding 100 deltas of equity, with a little bit of premium as an offset.

Cash secured puts are a popular way to take advantage of high volatility and stake your cash on the odds stock doesn’t close much below your strike. But being completely wrong about a vol level will pay out if stock rips north on even higher volatility.

All of these scenarios are “normal.” 15 vol is gonna do what 15 vol is gonna do. And rather often 15 becomes 20. Options buyers wouldn’t pay sellers if there wasn’t a chance for something more. It’s important to have a trade plan for whatever path the underlying takes.

Theta exists because there’s time on the clock, but that famous theta cliff is only really modeled on the at-the-money options. Like vega, time value falls quickly further away from the money.

Going back to the hedged equity example (short calls, long a put spread vs long stock), if you find the options have been reduced to near 0 greeks, it likely means the position is very close to expiration, or deep in the money.

Adjusting the trade plan between expirations might not help - it’s locking in an underlying price level if you’re far in the money. Market timing doesn’t align with the objective of the strategy.

However for more opportunistic strategies, an early and significant direction could encourage us to shift gears, and take profits early. With Early Vol, if we have a long call spread, FALC risk reversal, or covered call in place there’s an interesting debate about how to roll.

Like winning the first flew coin flips on black at a roulette table, many will argue to take your money and run. There will still be decent extrinsic value left on your positions - that 20% spike happens less than a third of the way to expiration - but all those strategies have all given you positive delta PnL.

Overall, the accuracy of volatility pricing is a piece of market efficiency to lean on. Investors are coming to the options markets to manage risk in underlying assets, and generally adjust their equity risk profile. Well priced vol on a tight spread is a good place to do that.

But we must not forget that path is the primary thing that matters for returns. Embarking on a new position we can make estimates of what the steepness or difficulty of that will be, but history unfolds on its own.

Knowing the difference between “collecting premium” and “picking deltas” is important for the put seller. The condor trader would do well to realize when a below average realized vol is a good time to take profits. Know where you came from, and how you got there.

Valley Forge Rd curls around the bottom of the reservoir, and is one of the few remaining indicators of the Village of the Damned. Here you’ll find Trout Brook Valley, a result we can all enjoy, but that came from much tumult. When the utility company attempted to sell off the land to golf course developers the local municipalities rallied to exercise their right of first refusal. Thanks to the efforts of local leaders - buoyed by the publicity of Paul Newman’s support - we now have 730 acres of pristine land to enjoy.

Why this land exists bolsters my appreciation for it. I don’t advocate making emotional trading decisions, but you should be sure to have a plan for whatever path your investment takes.