I believe that somewhere, in some time zone and climate, there exists the optimal routine for each person.

The thought consumes me in the shower as I try to plan my day ahead and in the evenings as I plot the more distant future. What does my perfect day look like?

Drawing on blank paper, that includes a run or bike ride in the late morning - some place where it’s still cool at 10am and I’ve had time to pick up the to-do list scattered by a large dose of coffee. Other must-haves are time with loved ones and an early evening apéro. Toss in some thought work to occupy my mind and grunt work to clear it. Set this all against a gentle vacillation of the seasons, where it’s brisk but not cold, warm but not hot.

Having a daily regimen that harmonizes your endeavors with your biorhythms, the weather, and friends or family sounds like the definition of true wealth. Not an escape from the ups and downs; but a system, order, and set of customs to tackle that with joy.

I’ve long had a fire under me to get things done early and often. I once threw a shoulder check at my soccer teammate as we scampered to be the first to place our math tests at the front of Mrs. Cooney’s third grade classroom. I got the goal, but wore the penalty.

Now it’s just an urge to front load the effort. Sorry I’m not sorry we got to the airport two hours early, that’s just an excuse to finish reading No Country for Old Men (again). It’s important for me to line my day up so that I can knock things out and then have the space and clarity to enjoy the remaining daylight hours.

For quotidien scheduling, that can mean putting the market at one end or the other of your waking hours. If you’re at a desk in New York, the 9:30-4pm schedule sits plump in the middle of the day. Time for breakfast before, reasonable to grab drinks after. Sitting in California you’ve got to catch the first train, so you can spend the afternoon at the golf course. Trading from Europe means a quiet morning but you’re reading Fed minutes while waiting for the entrees.

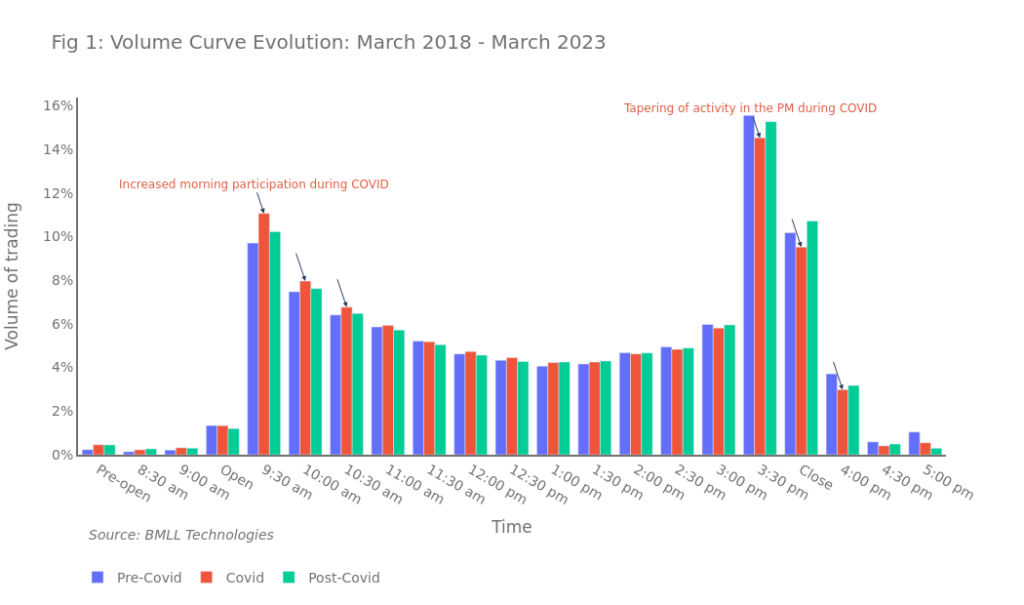

The funny thing about fitting trading time into your day, is that not all minutes when the market is open are created equal. The profile of volume across the trading session follows a distinct saddle pattern. US markets don’t close for lunch like they do in Tokyo, but the buy side’s fingers are usually too greasy to hit the sell button.

The below chart shows the classic saddle profile, and specifically highlights how during COVID there was a measurable increase in the percent of volume around the open - likely correlated with increased retail participation.

Packed into the 390 minutes of daily battle is all the activity that has been waiting the other 82% of clock time to transact. But action starts long before the opening bell. The NYSE accepts orders starting at 3:30AM, and performs the first trade matching thirty minutes later. Futures trade all night long at the CME, Ameritrade offers two dozen equities in “24/5” mode, and crypto doesn’t even take a day off for Christmas.

Most OCC guaranteed derivatives only trade during market hours though. SPX and VIX have had overnight sessions for several years, but the lion's share of volume happens during the day. Even if news is coming out, the most significant trades will only happen when participants know they are going to get the best liquidity.

Opening rotation is so named because it is a process of converting everything that has been stewing overnight into trading volume. Options exchanges accept orders several hours before the open, and good until canceled orders from prior sessions may now be more interesting if stocks have moved overnight.

Unlike any other time during the day, anyone with the right feeds can sit and watch indications of interest pop up, see crossed bid/ask spreads and be completely unable to trade. For liquidity providers this is prime orderflow to interact with, both because of its intent and the rules for how trades match on the open.

Anyone that has placed a limit order is by definition price insensitive. Sure, they care about that specific dollar amount, but not where stock is trading at execution time or what the implied volatility level is. Market makers want to extract as much edge as possible from that order.

The market structure at the open is also unique, where venues that are typically pro-rata allocation offer a winner take all auction at the open. Best to hold your interest until the last minute lest your competition carp you by a penny. Quoting requirements are also relatively lenient compared to effective market widths during regular trading.

This can be a double edged sword - for less liquid names the opening requirements feel stringent. Specialists (or DPMs or LMMs) have enhanced standards in exchange for a better allocation - the liquidity providers of last resort. While a quarter wide might seem like a gaping spread in AAPL 0.00%↑ , for a brand new listing with no implied vol history it’s like threading a needle.

The open shakes all these competing factors out, and the first 30 minutes are the busiest tranche of the day.

The character of order flow changes throughout the morning. After the pent up demand shakes itself out, the more gnarly orders start to work their way through the liquidity. For structures that require more complicated pricing due to thin underlyings, known events, or terms with little open interest, it’s a game not of microsecond auctions but back and forth instant messages with long pauses. It’s a process that requires everyone to be at their desks.

Once the character of the day has started to take shape, with overnight moves digested and news processed, volume tapers off. Itchy fingered execution traders have gotten their jobs done and chatter turns to lunch. The irony of the $10,000 burrito, is that as soon as you let down your guard and take your eyes off the paint drying, is exactly when it gets interesting.

Things start to pick up into the close again. Now that everyone has watched the current session mostly unfold, what do they need to do to readjust and position themselves for the next day. Market makers will need to hedge their books, and depending on the magnitude of this there are certain tail wagging the dog impacts on underlying equities or even indices.

Beyond the options universe are funds that want to rebalance their exposures, or adjust for the inflows and outflows of the day. Algorithms that have a “must complete” flag turned on start to get more antsy with their orders and work to clean up shortfalls.

If the open is an explosion of latent orders colliding once the lights turn on, the close is where all this wraps up and tickers stick their final print. Day traders must close out any 0DTE YOLO bets, and brokerage firms sweep up the messes of anyone short puts without the cash to cover an exercise.

The ebb and flow of the trading day is as predictable as the lapping of waves on the beach of your perfect routine. When the berry you’ve been waiting for will actually arrive is totally random, but viewed from 30,000 feet the order flow pattern is very predictable.

One of the more useful parts of the aquatic connotation of liquidity is that it pools. Volume and open interest are generated because people are getting together to trade. If you know the tightest markets happen at the close, or can guarantee a fill at the final print of the day with special order types, participants are going to flock to that because they know it represents their best chance of getting a fair price.

Of all twenty four in the day, the thirty minutes at the open and close are the hour that matters most.

This has important implications for execution. Most obviously, you don’t want to run a strategy on the VIX print from Hawaii. But for retail traders, a lesson would be to not send in limit orders pre market. Unless you absolutely have to, trading against live markets will give you a much more fair shake. Also, while it might only look like a penny or two, you’re better off trading outside of lunch hours - especially if you’re looking for price improvement outside a top ten name.

There’s a reason the most popular algorithms in the world are volume and not time weighted. We measure latency and expirations with a clock, but price and size must be used to measure fair value. If the VWAP is the most accurate reflection of a stock’s price over a time period, it’s because it recognizes that here fairness is denominated in magnitude and not frequency.

Measuring the trading day with a yardstick other than seconds is also demonstrated by the options pricing model. When you crack Black Scholes open, one of the inputs you’re asked for is time, expressed in some standard term like years or days to expiration. That clock time is perfectly linear - every second is exactly the same - but this doesn’t match how options prices actually decay throughout the day.

If you can only buy and sell equity options during market hours, it follows that most of their pricing changes should take place then. Buyer and seller imbalances move prices, and there’s no order flow after hours. Most of the options potential energy will be released or decay during that time. During one day's trading session, the option should lose one calendar day’s value minus any potential for after hours movement.

This is most obvious in the time leading up to a weekend. The same number of hours exist between Monday’s close and Thursday’s open as do between Friday’s close and Monday’s open, but options treat them entirely differently. News can always be released over the weekend, so you don’t want to treat these hours as if they don’t exist, but they certainly don’t have the same weight as hours that include two additional trading sessions.

Friday afternoon is a game of chicken in reverse. Every player is slowly backing away their bids in an effort to not get planted and overpay for options that don’t move over the weekend. In the olden days we had a knob to manually ratchet “days ahead” into the pricing model so your theoretical values would decay faster, now there are algorithms for timing this price evolution.

If you don’t care about time, you can simply buy equities. Options add the spice of duration to your investments. This is very useful for defined outcome products - if X happens by Y date, I know I will make or lose Z. When talking quarters and years ahead, the calendar is a perfectly useful tool to parse up the days.

But as we zoom in closer and closer, we can see that time bends in curious ways. The five seconds a specialist has to open up options trading after the stock’s first print could be worth a sedan, while the hours around noon don’t pay for lunch. As variance and order flow are both random, the best way to capture either is to saddle up into a good routine.