Product development is exploding in the options space.

If we track the headline OCC volume, the numbers are strong. The gyrations of April drove record daily figures, one day topping over 100M contracts. Growth is coming as brokerages expand their options platforms, and investors become more educated about the potential for these strategies.

While muted compared to the pandemic era markets, there are still the YOLO call buyers. The new scapegoats are “vol tourists” who look at every implied volatility spike and try to sell premium, confident in the mean reverting properties of variance. This isn’t just retail, plenty of sophisticated investors are playing that game too.

Uncertainty brings about activity. Whether it’s rushing to put on a hedge, or unwinding the leverage in a bleeding position, choppy underlying markets either force or incentivize immediate and short term trading. Prices out of whack creates opportunities.

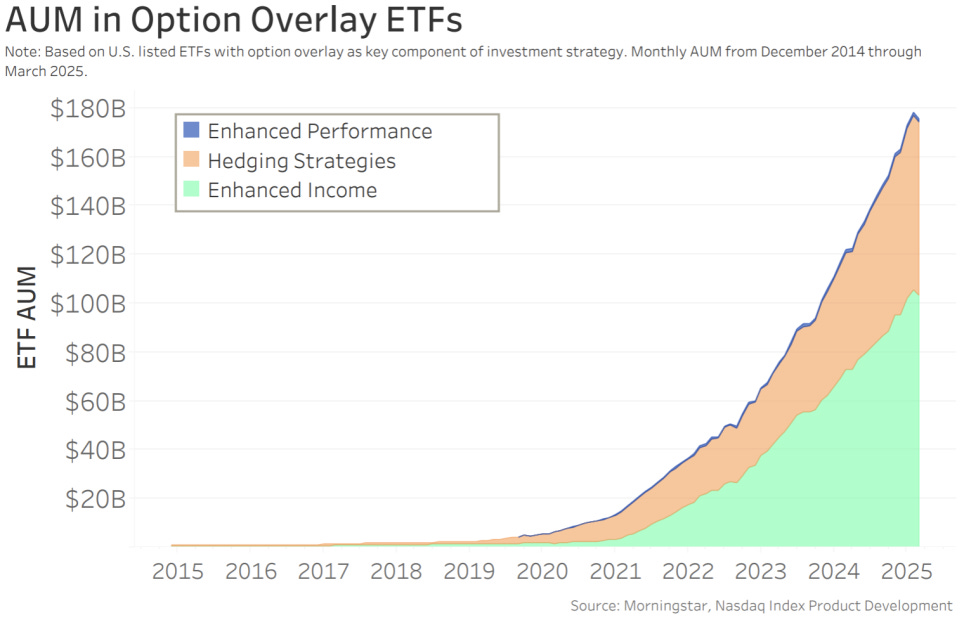

But the growing popularity of options strategies is not just a function of speculative or panic driven trading. Whether they’re trading weekly, monthly, or quarterly, the listed ETFs that trade options as part of their strategy are bringing persistent orderflow to the market. And their AUM is exploding.

Covered call ETFs have existed for nearly 20 years. Ivesco was the first to sponsor the PBP product in 2007, seeking to track the returns of the CBOE BuyWrite Index. Every month a slightly out of the money call gets sold on the S&P 500, and continuously rolled forward. It wasn’t until 6 years later that QYLD came along to start overwriting the Nasdaq-100 index.

Thanks to two year old legislation opening the floodgates on active ETF management, today we have the "the most unownable new ETF, $MST, the Defiance Levered Long+Income MSTR ETF.” The frankenstein combination here has everything from daily leverage to options overlays. There’s no fixed parameters for either, and you get charged a hefty 1.3% management fee. (h/t to Dave Nadig here, the full post is worth it.)

It’s difficult to find a reasonable place for that in any portfolio. Even if you can square on the objectives, the lack of transparency, transaction costs, and management fees will cut you up. But this wasn’t cooked up out of nowhere, and within 2 weeks of launching has amassed $35M in capital.

While I picture bohemian tapestries and the waft of incense coming from the brainstorming sessions for these new launches, the demand doesn’t lie. Investors want one of three things from an options ETF - leverage, protection, or cold hard cash. Ideally all three.

While buffer products and hedging strategies were initially the most popular, since 2022 the enhanced income bucket here is taking a majority of the market share.

If dividends aren’t driving enough distributions, consider selling options premium. And if that’s not enough, enhance it once again with the now classic return of capital trick. No bother that NAV degrades over time, it’s still nice to see cash in the brokerage account.

Unless underlying returns look like the chart above, the more you enhance a distribution, the more the principal balance erodes. If you’re trying to maintain a fixed cash amount, portfolios drop faster and faster. Alternatively a fixed percentage yield becomes smaller and smaller.

Last week in Portfolio Design I looked into a strategy where an investor could overlay options on SPY to generate monthly distributions. By varying the delta and size of weekly call sales, the strategy optimized for a target distribution while preserving capital and participating in growth.

Letting it all get called away

From the moment the tooth fairy first drops dental earnings under the pillow, investors are focused on savings.

I’m not here to say that $100B in these strategies is wrong. Fighting a hockey stick curve like that lands you with a black eye in the best of cases. What’s important is to understand the underlying motivations for this type of trade, and how to align those with the best possible implementation.

There is a distinct behavioral component to this desire. Mental accounting separates income from wealth. We think the guy driving a G-Wagon is rich because he can afford a monthly payment, while the lady in an old Camry is sitting on 10,000 shares of VOO. Distributions feel like earnings, while selling shares feels like depleting.

Baked into our tax code there are nudges in this direction. Investing 101 teaches you that dividends and interest are treated differently from capital gains. But there’s a lot of nuance about qualified, ordinary, and holding periods. With distribution focused ETFs, all of this gets passed through and trued up at filing time.

A $0.50 distribution will contain some portion of returned capital (no tax implication today), but also some Net Investment Income that has components of short term gains, ordinary income, and regular dividends. You can’t avoid the character of your investments.

Loss aversion also has us tending towards the comfort of distributions. Whether you’re using SPY or COIN to generate yield, the future is uncertain. Monthly payments aren’t the only risk to principal - bear markets and tariff tantrums will also cut your equity balance.

Regular and fixed distributions also help investors mentally weather the inevitable volatility of equity markets. Getting paid even when balances are down is incredibly soothing, and also helps to match regular expenses to cash flow management.

To meet that monthly distribution target a strategy will have to sell shares in both down markets and up markets. While the fixed selling isn’t ideal in down markets, there is an argument (validated or invalidated by specific path) that regularly siphoning off cash prevents a knee jerk decision to sell when prices are screaming red.

Passive income has a social cache to it. It could be a depression era mentality that warns us never to spend down principal. Or a need to gloat on TikTok about being financially independent living off dividends.

It’s also a lot easier to read a yield figure and make a prediction about the future returns than look at SPY $586 and wonder what the pricing of discounted cash flows will look like over the next period. No amount of soap boxing will prevent investors from leaning on the basic mental arithmetic of an annualized percentage.

Rational purists can dismantle these inclinations and preferences as sub-optimal. Sharpes and CAGRs are quantitative swords to cut through these gooey feelings. But if investors are consistently choosing this AND reporting higher satisfaction - isn’t that the real alpha?

The question thus becomes - how do you build a better distributor? How can we take the infinite wisdom of the volatility surface and fit that into a framework that provides regular cash flow for as long as possible.

There are numerous directions to go, and tomorrow in Portfolio Design will dig into the specifics. We’ll use the YieldMax suite of products as our benchmark to adjust for both capital preservation and net distributions. In almost every dimension a home grown strategy will outperform.