“I suppose it is tempting, if the only tool you have is a hammer, to treat everything as if it were a nail." - Abraham Maslow

Hammers are, in fact, quite useful tools. They are incredibly effective at placing nails, fairly good at removing them, and generally useful in coercing things into and out of place.

Growing up I remember seeing my dad’s beat up red tool box, and wondering how you were able to hold on to something that long. My toys had a half life measured in weeks, and this hammer was multiple times older than me.

My own hammer is now going on its thirtieth year. After seeing the look on my parents' faces when I was gifted an adult tool set, I didn’t think any of these weapons would make it past New Years. He didn’t make it to college (fortunately), but the hammer crammed into a couple Brooklyn apartments, a Chicago brickstone, and now sits on a 2x4 shelf in a Connecticut basement.

At least a hundred pictures have been hung; swift, simple strokes. Even a barn inspired bed was built - only to be disassembled at bachelorhood’s funeral. More recently it has tapped stone into place, and framed the replacement trash shed we lost in a cutthroat purchase negotiation.

If I only had one tool, it would be a hammer. A screwdriver might fasten better, and a miter saw gets a lot of reps, but nothing compares to the flexibility of a heavy ended mallet.

Looking at the options markets, there are infinite possibilities for trades and investments - much like the green field of a new construction project. There are nearly as many different lenses to look through when evaluating these opportunities. Something as basic as calculating the implied volatility has more flavors than Baskin Robbins.

So amidst all the indicators, analytics, and crayon scribbling on charts, is there one tool that we can’t trade without? The straddle of course.

The straddle might not be the first spread that you learn about in Options 101, but it’s the most descriptive. It’s only the sum of the call and the put price on a given line, but straddles tell you more about the stock than nearly any other datapoint.

Typically we use the at-the-money straddle; the strike closest to forward value. That’s usually near the current stock price, but so long as we have material interest rates, for further expirations add in the risk free rate and subtract dividends to find the true ATM strike.

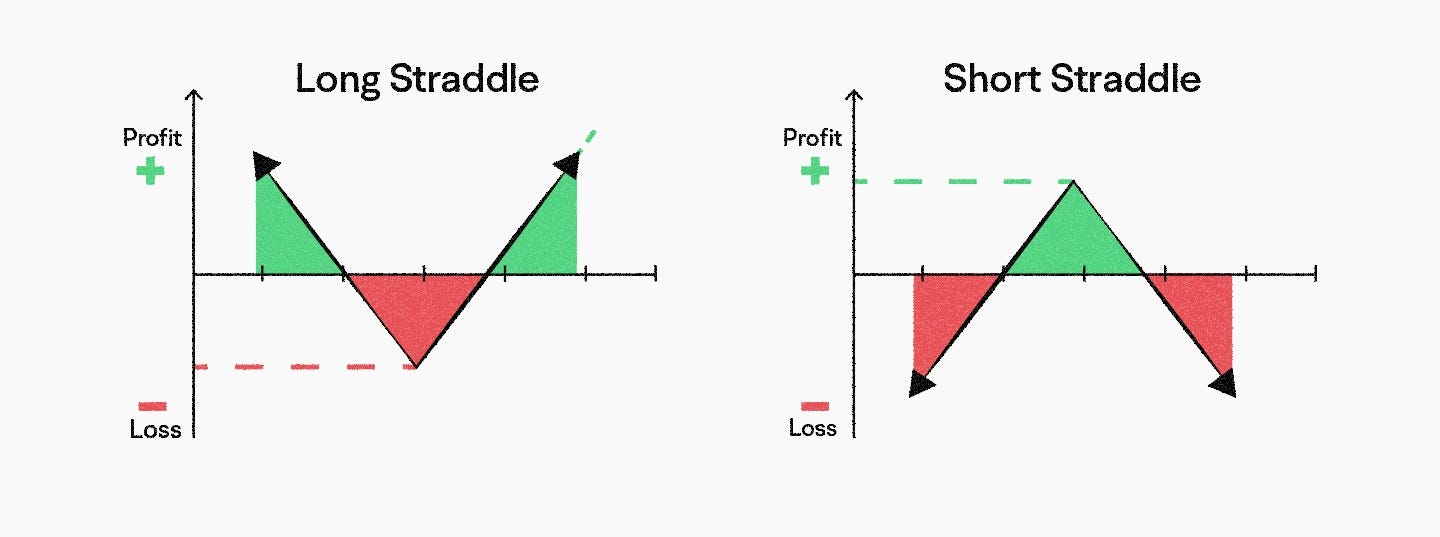

A straddle reflects the expected movement of that stock between now and expiration. If you buy a straddle you are long the call and put, and at expiration make money when the spot price closes further away from the strike than the amount you paid for the spread. Conversely short straddles win if stock doesn’t move.

The amount you paid for the spread is the both the height of the triangle, and the breakeven points. Shorts stand to make at most the premium collected if stock sits perfectly at strike (calls and puts both go to $0), and a long can make up to the strike price minus debit on the downside, and has theoretically infinite upside.

From an exposure perspective, it’s pretty simple. Unlike call spreads or butterflies, these are unbounded risks. Capping the downside at $0 is rarely any consolidation.

Straddles are bi-directional. You’re not making a prediction about which way the stock is going, just that it will move more or less than expected. This sounds a lot like a volatility trade, and it basically is. The market has one opinion about movement, and you’re trading contracts saying the opposite.

Straddle holders are explicitly short or long gamma, theta, and vega. The long wants to pick up favorable deltas as stock moves away from the strike price (gamma), and an increase in implied volatility raises the price of those options (vega), whether they’re moving or not.

Time on the clock is everything for a straddle. The implied volatility will move prices as expectations change, but potential only exists with space to perform. Longs and shorts both watch the theta decay curve fall into its final settlement price.

Annualized percentages are useful to normalize for a model, or compare across issues, but they require some conversion to think about an options value. Most expirations are far shorter than that, and what we’re really concerned about is how much the stock is going to move for these contracts. What’s the straddle? Short and simple.

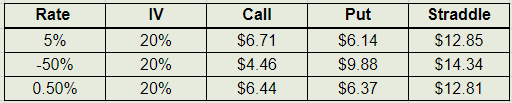

Implied volatility will be the main axe that moves straddle prices, but interest rates can change the value too. They not only skew the distribution away from the current stock price, but increase the overall price of the straddle. We can see below how a 2 week straddle in SPY struck exactly ATM ($542) changes with extreme interest rate moves.

For trade setups, the straddle is an important definition to keep in mind. Earnings and other event trading requires us to make a prediction about how much a news release will move the stock. Whether you’re putting on a butterfly, call or put spread, the straddle is a simple benchmark to summarize market expectations.

With premium generation strategies, the straddle can be used to identify the ranges for overpriced options. Cash puts traders put up their capital to collect the risk premium in downside options. Using reports like Expensive Puts, we can identify the puts trading beyond the straddle price that also meet fundamental and volatility screens.

In listed equity options, the straddle is the most intense volatility position that you can put on. They’re used by professionals in advanced strategies like volatility risk premium (VRP) capture or dispersion trading. The catch here is that vega peaks at-the-money, and as underlying stocks move, PnL will have an additional element beyond just relative volatility. Constant hedging and rolling.

For 0DTE traders, you can use a simple short hand to convert everything into a one day straddle. Take the implied volatility percentage and divide it by the square root of 252 trading days in a year, or about 16. A thirty day implied vol of 18% says to expect roughly 1.14% moves on a daily basis.

While it is useful for many applications, the straddle does have shortcomings. High volatility will raise the straddle price, but the full strip of options values tells us much more about the expected distribution than two prices alone can. Skewness to the downside or upside reflects the market opinions about how movement will take place if the spot price moves towards that strike.

Straddles are also a dangerous tool to trade directly. On the short side they represent infinite loss potential. Longs must also be careful at paying for the most expensive carry on the board. For most investors they’re better used as an indicator than a position.

The sum of the at the money call and put summarizes more information about volatility in a stock than any other spread or quantitative metric. And it’s two simple prices that are just a function of market supply and demand.

The straddle is your hammer.