Hold my beer; someone’s talking about liquidity.

It was a cool summer evening, and I was outside socializing with a few colleagues. I’m not sure why Prospect Park was chosen for the outing, but we were mingling under the large native oaks that dot Olmsted’s rhomboid counterpoint to the verdant rectangle in Manhattan.

After a couple of attempts to talk about real life, the conversation inevitably drifted back to markets and trading. The group behind me was talking about how the reversal conversion that was tied to a single stock future and offered this morning seemed too good to be true. Because it was the no-div contract! This was of course absurd, because no one would pay $0.30 to get long stock if it didn’t include the dividend. Find better customers, Harris.

I had fallen in with the market structure geeks, and they were talking about all the activity in 0DTE options and whether or not that was bringing in new participants or just getting more trading from the current players. The question was a perfect debate for half full glasses - no correct answer but plenty of cud to chew.

Every trader - quant or qualt - has an ego, and Brooklyn hefeweizen has a way of inspiring confidence. My self described interlocutor boasted how they had developed a system to track liquidity and were using this to predict where to deploy more of their quote streaming capacity. Somewhat familiar with liquidity metrics myself, I was defensively perched at the edge of my IPA.

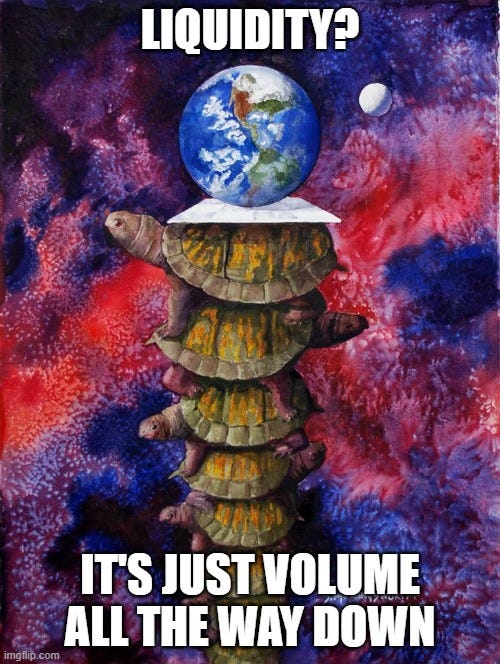

“Well it’s simply a function of the volume, times the volume, times the volume…”

“THAT’S JUST VOLUME CUBED!!”

….I shouted to myself as I bolted awake.

My pride in dissecting this simple equation immediately bloomed into a mildly embarrassed shock and then a chuckle. I rolled over and took a mental note.

The irony of this faux-confrontation is that if you want to come up with the simplest algorithm to gauge liquidity, you wouldn’t be too far off by taking volume to the power of three. Open interest and market width are very important, but they are derivative to volume. Underlying liquidity matters, but that’s volume based too.

I’ve said many times that liquidity is the ability to get into and out of a trade. When liquidity is high, this is easy. Trades happen with little slippage, friction, or delay. Filling an order on low liquidity requires deft maneuvering, patience, and tolerance for a little bit of risk.

Measuring market liquidity is tracking the ability of buyers to meet sellers. When those parties collide and congress, the artifact remaining is volume. Liquidity without volume is impossible.

Is the opposite true? Can volume exist without liquidity? This is either a market maker's dream or nightmare. The worst case scenario is a large order with no one to fill it. Volatility and rates get repriced in real time and someone is going to feel pain, because no one knows what’s going on. If there’s a one direction imbalance, head for the hills.

If there’s two way flow on wide markets, that’s a fat opportunity. A customer might look at these wide markets and say there is no liquidity, but that’s different from expensive liquidity. Unidirectional orderflow that drives through multiple levels is different from active price discovery around a highly uncertain variable.

Volume creates liquidity. It will not be instantaneous, and contras don’t magically appear to fill the outsized order in a thin name. The market mechanism that pushes prices back in line takes time. Fool me once and you can have a large print in a Tier F name that swamps the market. Come around again and the sellers are waiting.

While the pithy repartee about volume cubed was nothing but somniloquy, there are three important ways that volume helps to manufacture, sustain, and promote liquidity.

Within the scope of a specific product or asset class like options, there is a notion that liquidity begets liquidity. When that outsized order comes in and finally finds a clearing price several ticks through the offer or bid, participants take notice. They might not have had their trading permissions set up the first time, or cleared access with their risk manager, but they won’t be fooled again.

Volume attracts new players because volume is what pays their bills. The first thing any market maker looks at when the closing bell rings is their PnL. The second thing is how much volume his peers are doing and what names are trading.

Liquidity providers follow the cheese. In the short term, firms begin by deploying more quoting capacity in the form of eyeballs and CPU cycles. Within minutes, maybe hours, and certainly by the next day, the current cohort of players will have “sized up” to the opportunity presented by new volume.

More volume also attracts more and different players to the industry more broadly. Dealers in other asset classes like futures or commodities that think they can commute their chops will expand their footprint. Buy side retail or institutions will also be attracted, and bring in offsetting flow to bolster the virtuous cycle.

The volume from these new players naturally brings about more liquidity. The market clearing price for 100 contracts will be lower if there are multiple counter parties rather than one. The price will be lowered even further if those counter parties have confidence there will be more opportunities, i.e. volume, in the future.

Once the activity has drawn in new participants or bigger size, competition heats up. The snowball effect that volume has triggered pushes players both new and old to tighten up their markets. A dime of edge may now be too much to ask for as the market gets more confident in pricing.

This happens in streaming lit markets as dealers lower their edge settings and are willing to join markets with less edge. A quarter becomes a dime and then a nickel wide. Auction orderflow becomes more competitive as respondents are willing to give customer trades lower and lower EQ (execution quality) figures - all the way down to mid-market 0.

High touch orderflow is not immune, as IMs get returned with trading levels below your tightest offer. Brokers lean on dealers to provide better and tighter markets, and with a larger pool to fish from, there’s always a guppy willing to bite. (Electronic markets help this - pit dynamics reinforce collusionary tendencies with the threat of getting taken out to the horse.)

Volume is the driving force behind liquidity because it brings fresh capital and attention to the marketplace, and that interest will accelerate price discovery by carping prices tighter and tighter. It is also a signal. A stream of contracts trading means when it's your turn to close out, someone will be standing there.

The bigger the random pool of orderflow is, the sooner you’ll get out. Not just because you’re waiting for the exact opposite order to materialize, but because an intermediary will be able to fill you, having confidence that other order will come eventually. Dealers arbitrage inventory value over time, and charge you the bid ask spread. If that inventory is cheap to turn over, the confidence interval around fair value will be tighter.

Even if you hold your trade to expiration, volume matters to your exit plan. More volume in options leads to more equities volume, which leads to more accurate pricing of the underlying. In the short term flows and liquidity gaps can cause price to settle “incorrectly” on any given day. The more people that guess the number of gumballs in the jar, the less collectively wrong we’ll be.

Alas, though volume is the root of all liquidity, there are some other interesting metrics to consider. In my own analysis, I look at open interest, because that’s a measure of dormant volume. Those are trades that took place in the past - so at one time there was liquidity, but OI also represents an increased potential for orderflow in the future.

The spread width (as measured in implied vol terms, not pennies) is also interesting because not all names of equal volume have equal market widths. More contracts will drive spreads tighter, but the wider the scope of outcomes, the further apart the bid and ask will be.

Every options trader should care about liquidity. Whether it’s an overlay or opportunity capture, the ability to get into your trade, roll it, and close it matters. I like to think about all the little dimples and warts that make liquidity interesting, but a pretty good yardstick would be to just cube volume.

A Note from Our Sponsor:

Harvested Financial has just launched a new blog series, a real time tutorial for TheTape.

Take a look behind the scenes here: Football Deal Flops, Who will walk away with the keys to $MANU?

Three times a week, our Trading Opportunity newsletter walks through the trade development process by looking at current market scenarios. We start with the LIQ indicator to monitor for spikes in volume, open interest, or spread width. Then, by using constant duration indicators we can better understand how the volatility surface is moving. Dig further into the analysis with VRP Lab or Stable Skew.

Designed for traders of all stripes, a subscription comes with full access to TheTape.Report.

Identify. Analyze. Execute.

15% Off with AUGUST2023