Where price means quality

Vol #250: November 6th, 2025

The front fell off. That wasn’t supposed to happen.

The brand new to us table that felt so perfect, now had part of its top on the floor. A chord bisected the circle and we have a geometry problem.

The thing with antiques is that they’re old, and this one has started to break down. To make a butcher block, pieces are lined up true in a frame, glue is applied between all the seams, and a series of clamps tighten it all up to dry. A table maker can get overly enthusiastic, and if the seam is pulled too tight, there’s no room for the glue that binds.

After a long history at a tavern in Stowe, Vermont, this table had found its way south to a barn in Connecticut. Aesthetically it was perfect, and the pedigree was romantic. A treasured find that gave in upon the sight of its new home.

Going back to the dealer, I got a response that sounded a lot like the government official explaining why his ship’s front fell off. No matter, I’ll pull out the self centering dowel jig and repair this myself.

The price paid was not an indicator of quality here. The jury is still out on value. All the je ne sais quoi about this was charged in both cash and time spent repairing what I thought was a finished product.

One of a kind is expensive. I dread paying another red cent to Pottery Barn, but there is a certain comfort in knowing that someone stands behind the product, and isn’t just a middleman with a pile of old sticks. That coffee table might be at a dozen different houses in Westport, but it stays together.

A single trade happens because two parties want to exchange goods, labor, or cash. A lot of trades happen because there is a robust infrastructure that gives people confidence in the quality of every transaction. Quality means delivering the best price at trade time, resulting from execution, clearing, and participants that back that up.

Roughly seventy million options contracts are trading hands every day. Breaks are not handled with woodglue and pegs, but clerks rectifying price and account location. Forget about Paul and his warehouse, here are eighteen different exchanges aggressively competing for your order.

That seems excessive. Maybe it is. But the incentives here that support and encourage participation make this one of the best possible marketplaces around. That’s how you get the best possible price.

A couple pieces of wood glued together with a good story is greater than the sum of its parts. Sometimes by a lot. That’s much less true in options execution - save the stories for after the bell. Price is king. The markets are built such that mechanisms and regulations drive customer fills to the highest possible sale and lowest possible buy.

At trade time, a good trade means you got a good price. (Over time a good trade means you got both a good price and the right direction. That second part is on you.) Price is equivalent to quality. It’s the number one metric that brokers judge wholesalers on - where did you fill my orders compared to the lit markets.

It’s hard to argue with the cold hard math of dollars and cents, but the definition of best execution does allow for some wiggle room. There are some valid reasons why a customer might accept a price worse than the national best bid and offer (NBBO). A single block fill might be more valuable to a portfolio manager than having a long trade window to monitor with open risk.

Brokers can argue that market impact or likelihood of execution would cause them to route somewhere other than the best price. Or perhaps something about the nature of the order necessitated an exceptional routing decision.

But particularly as markets get more liquid, there are fewer and fewer footnotes to distinguish execution quality from price. Trading algorithms allow the buy side to source liquidity intelligently, and well capitalized participants still physically elbow each other out of the way to price improve the largest orders.

If you find yourself in a qualitative validation of quality, things get muddy fast.

“Quality—you know what it is, yet you don’t know what it is. But that’s self-contradictory. But some things are better than others, that is, they have more quality. But when you try to say what the quality is, apart from the things that have it, it all goes poof! There’s nothing to talk about. But if you can’t say what Quality is, how do you know what it is, or how do you know that it even exists? If no one knows what it is, then for all practical purposes it doesn’t exist at all. But for all practical purposes it really does exist.” - Zen and the Art of Motorcycle Maintenance

For tables, motorcycles, and strawberries, quality is a bit more nuanced. There’s room for differing opinions about aesthetics or heritage. The weight you place on biodynamics might be different than mine, so we have diverging views of price and value. Quality and price separate, and may be subjective.

But on any given trade it takes a significant argument to overcome the idea that price is not quality. Over time and across many orders this becomes even more true. And the reason we have quality markets supporting seventy million contracts a day is partially thanks to exchange proliferation.

Good trades happen because the market place allows for little else. No one can promise PnL, but I can say very confidently that almost every single trade you make in the options market will be a good one.

I’ve discussed previously why the broker/market maker relationship that processes retail orderflow is so powerful. The big wheel keeps turning because at every step of the trade lifecycle customer orders are prioritized. Market makers both initiating and responding to auctions fight to trade at ever better prices to the customer. Brokers review aggregate statistics and lean on business relationships. And finally the regulators have oversight to make sure the mechanisms are fair and everyone is behaving as they should.

While dealers will be frustrated about the new connections and market data feeds additional exchanges require, different ways to trade orderflow is what keeps improving the quality of options trading. And for customers, quality is synonymous with price.

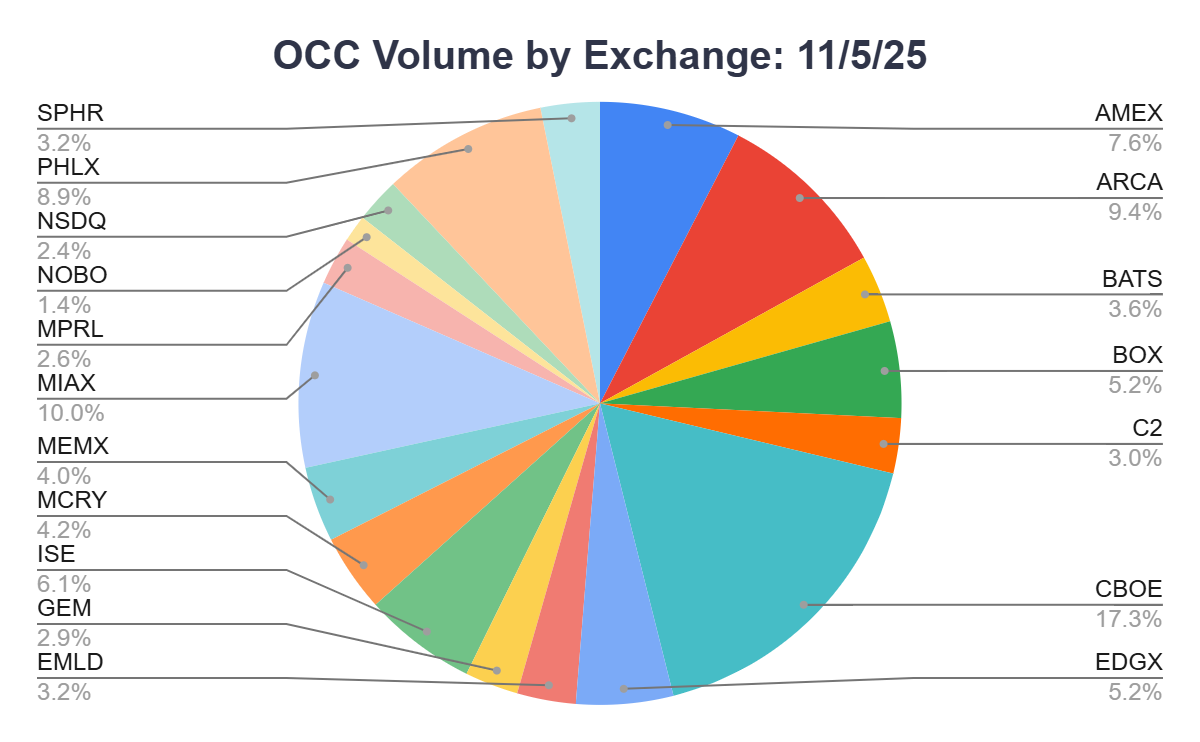

Looking at yesterday’s volume it was well split across different venues. The dominant spot was the CBOE, and that deserves an asterisk because of the exclusive listing for SPX and VIX. There are bigger and smaller venues, but it still takes five exchanges to cross 50% of market share. The little guys each have their own value proposition, proven by volume.

Execution happens slightly differently in each place. A penny cheaper to post here, or a blind auction there. Some venues have unique electronic facilitation mechanisms like the ISE, others have robust open outcry trading like ARCA.

Routing across these locales is no simple task. As executing brokers navigate volume tiers and likelihood of fill, there is endless complexity. Matching engines might be perfectly deterministic, but several other participants are trying to push their orders through just as fast as you.

Savvy dealers will make routing decisions based on the quality of orders to their risk book in a Red Queen race to stay ahead. But the evolutionary biology of a competitive marketplace means all the other participants see that cheese move, and snipe in to improve. The offering additional exchanges and venues provide, is an ever finer grained way of segmenting the trading.

There are of course limits to the idea that proliferation is a good thing. Fragmented capital generally weakens price improvement, and participants drowning in market data and fee complexity have a hard time focusing on their core job. Just because you can copy/pasta a new market model with a dash of red pepper, doesn’t mean that you should.

The primary, and arguably sole, determinant of quality in options trading is price. The marketplace exists to deliver high quality prices. You’re not buying anything that isn’t completely fungible. New open interest is manufactured instantly upon trade execution.

Whether that trade is valuable is a completely different and complicated question. But as for the trade itself, it will be of the utmost quality. In other words, almost every trade is at the best possible price.