Nightclubs blast music so loud you can’t hear yourself think. Casinos only have windows on the doors so you can’t tell whether it’s day or night.

It’s time to get caught up in the moment.

Financial bubbles are marked with chyrons surging green tickers and profit goblins spouting every piece of advice because anything works. Perpetual motion and infinite growth are self-evident.

Anyone suggesting the opposite is a doomer who doesn’t get it. You don’t talk about hangovers at the party. The in group doesn’t just exclude naysayers, there’s a one upmanship game of being the most enthusiastic.

During crypto’s bull run of 2020-2021, blockchain enthusiasts were speed running the future of money. The prices of tokens would increase indefinitely because look at the left hand side of the chart and think of the total addressable market. Napkin math with the Fed’s balance sheet and notional derivatives exposure lead to an ETH price with six digits before the decimal place.

It wasn’t just enough to wear a Bored Ape hoodie pumping your brand and NFT prices. Owning Bitcoin or Ethereum wasn’t enough either. Rather than being long, you had to be irresponsibly long. So long that you were sleeping on a mattress in an empty room with only a laptop for furniture.

It’s a cheap shot to take a screenshot and juxtapose it against the price chart. I’m still holding the ETH I added to my position in October of 2021. I post this not because it’s a good lesson about position sizing, or because it’s a reminder of who you should be taking advice from.

What’s interesting about this, is how it memorializes the retail trader as being unable to contain their emotions and pile into trades irresponsibly. The author is a former hedge fund manager, so whether or not this was true, it also shows that institutional investors are not much better either.

Retail traders are always looked upon as a little bit naïve. The caricature of an options customer is a goofy middle aged doctor who has a hot stock tip from his golfing buddy. The dealer happily fleeces him for a fat profit because Doc has no idea what implied volatility is.

When options with daily expirations began getting explicitly listed (Expiration Friday has been 0DTE trading since the first call was ever bought) there was much concern that individual investors were throwing away money. Bloomberg ran a headline “'Degenerate Gambling' in Zero-Day Options Thrills Retail Traders.”

A few months back I debunked this and pointed out how the price improvement here is actually some of the best in the industry. Yes there is more volume coming in here, and yes that means greater notional “negative edge”, but the effective spreads and pricing is top tier.

There have been several different studies done about who is using these tools and why. The Ambrus group, Bank of America, and now CBOE have all produced research trying to understand what strategies participants are creating with these unique risk management products. Are they net buying or selling? Does the orderflow have second order effects on market movements?

What I find most interesting about this newest study, is not which direction the orderflow is going, but the texture of it. Customers are distinctly net sellers in this period, but over 95% of that is in defined risk structures. They are highly responsibly short.

Spread trading is the best way to take advantage of options, particularly on the short side. By pairing a buy and a sell order you precisely define the amount you can gain or lose. Unbounded risk - long or short - is difficult to model, but knowing you sold a $5 call spread at $2, it is easy to define your gains as the credit received and the loss as the difference between that and the vertical’s maximum value.

So while opening trades on the short side is about 7x more popular than on the long side, the vast majority of them are spreads or overlays. I actually enjoy the one day covered call trade even if it’s not perfectly rational. If the SPX goes up by 1.5% today, I’m happy regardless, so I’ll sell a few nickels here to pay for my lunch.

Another interesting feature this graph highlights is how popular the open is. Within the first thirty minutes of trading almost thirty percent of the opening shorts will have come in. Customers are smashing the red button as soon as the bell rings, and hoping the market moves away from their strike.

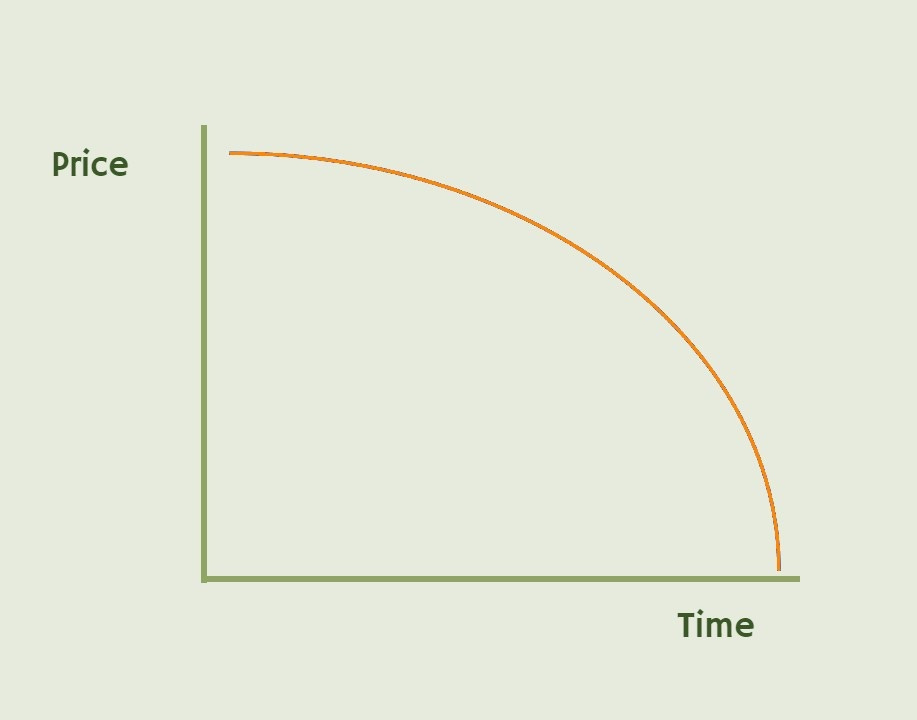

An ultra short term strategy is predicated on theta decay. You’re trying to capture the steepest part of the curve, where in those final 6.5 hours of trading, everything goes to 0 or 1. Early in an option's life not much changes, until it all drops out at the end.

Short term options are both expensive and cheap. Buyers like them because it’s the most bang for your buck greek exposure you can get. If there’s an upcoming event you’re concerned about and the rest of your book is short, buy some cheap options that expire today. The shorts think they’re expensive, because so much premium is going to go away in such little time.

The above chart tracks how that premium decays throughout the day. On the days when there were FOMC announcements, ATM prices started much higher because everyone knows there’s a big concentrated hunk of variance on that day. As soon as the news gets released, the prices quickly plummet.

Responsibly selling options will work until it doesn’t. That’s why it’s best done as a spread, because if you’re naked short, the days when the market moves 2% are going to crush all the little nickels you picked up along the way. Volatility or variance risk premium is both real and consistent, but you have to take some risk capturing it. Defined options structures are the only way to do this.

Being responsible is difficult, but not as difficult as being short options. The psyche of a credit side trader has to be framed in steel. When you’re running a strategy that makes a nickel 20 times and loses a dollar once it sounds like positive edge, but the day you lose a dollar is brutal. If you’re only trading weekly, it requires 5x more stamina than turning it over daily. The instant feedback not only tells you about the current trade, but means you can get more shots in less time.

Zero day to expiration options will only expand. It’s logical that only the most liquid indices and ETFs have them today, but the same as with listings standards, dollar strikes, and weekly options, these are likely to spread.

While I’m not envious of those who have to purchase server capacity to process all this market data, more choices and more volume are good for the industry and investors alike. A richer menu of options means more unique strategies and opportunities.

A note from our sponsor: TheTape.Report

This week on Trading Opportunity with TheTape, we covered the following:

Healthcare Arb Winds Down: Is saying goodbye to $KVUE sweet or sour for $JNJ?

NO PAYWALL!

What is the best tenor to trade for protection?

Booming LIQ, but collapsing spreads

Skew is relatively expensive, but cheap compared to the overall market.

Target Tightens Belt: Can retailer $TGT weather the shift in spending patterns?

Flattening skew and rising vol makes condors bid

Capturing implied volatility with a directional bias

Setting optimal duration for earnings trade

US Steel Braces for Battle: $CLF gets rejected with its first offer for $X

Does a more stable rate environment help deals?

$X was popular for buy-writers - what now?

Any suspicious orderflow from Friday's session?

For Portfolio Design with TheTape, we talked about $TSLA:

Taming the Technoking: Stock is settling and vol is down - sell the storm or brace for the calm?

NO PAYWALL!

Cross term skew has faded, but near term calls still offset a significant percent of long term puts.

VRP is ranging from 5-10% at 30 days, but implied vol can easily move 20 points.

Can a Condor be an overlay?

Both newsletters come with access to a suite of reports at TheTape.Report. Learn how to analyze opportunity through the lens of liquidity and spreads with our Real Time Tutorials, and bolster your own trading with in depth analytics.

Every subscription comes with a seven day free trial. Find out more on our website today.